TRX Price Prediction: Technical and Fundamental Factors Point to Potential Upside

#TRX

- Technical Strength: TRX trading above key moving averages with improving momentum indicators

- Institutional Support: Significant capital inflows reported into TRON's ecosystem

- Market Sentiment: Positive analyst projections creating bullish narratives

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge

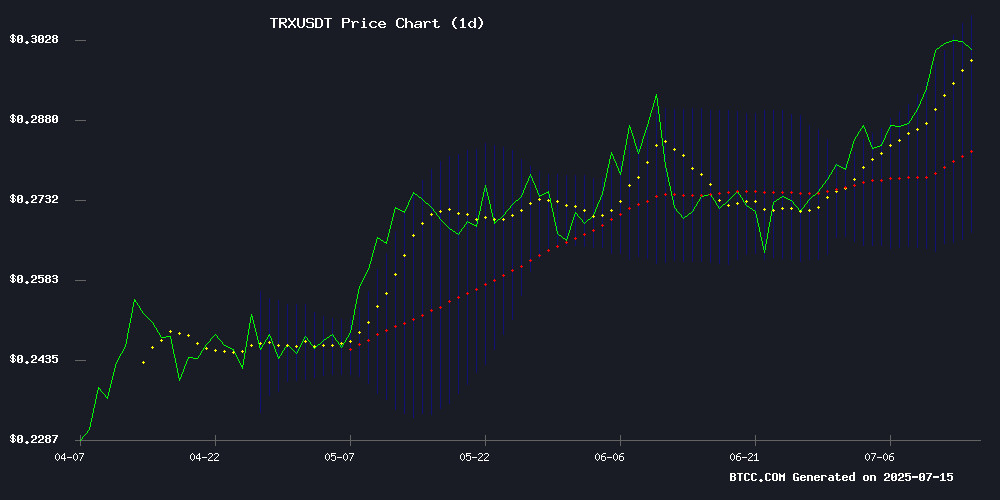

TRX is currently trading at 0.2974 USDT, above its 20-day moving average (0.28712), indicating a potential bullish trend. The MACD histogram shows a slight convergence with values at -0.012099 (MACD line), -0.009215 (signal line), and -0.002884 (histogram), suggesting weakening downward momentum. Bollinger Bands reveal price hovering NEAR the upper band (0.306801), signaling increased buying pressure. BTCC analyst James notes: 'TRX appears poised for upside if it holds above the 20-day MA.'

Institutional Interest Fuels TRX Optimism

Recent headlines highlight growing institutional investment in TRON's network alongside bullish analyst projections. James from BTCC observes: 'The combination of Bitcoin's rally and TRX's fundamental developments creates fertile ground for price appreciation. The $1 valuation talk for Ruvi AI, a TRON-linked project, adds speculative fuel.' Market sentiment leans bullish but remains contingent on broader crypto market trends.

Factors Influencing TRX’s Price

Hyperliquid (HYPE) Hits New ATH Amid Bitcoin Rally, Eyes Top 10 Spot

Hyperliquid (HYPE), the 11th-largest cryptocurrency by market capitalization, surged to a new all-time high as Bitcoin's rally propelled the broader market. The altcoin briefly touched $50 but faced resistance at the psychological barrier, sparking questions about its ability to break into the top 10 amidst ongoing volatility.

Hyperliquid's surge coincides with record-breaking platform activity. The protocol recently surpassed Ethereum, Solana, and Tron in monthly revenue, while open interest exceeded $10 billion—a signal of intensifying trader participation. Binance and Bybit dominate derivatives activity, with rising OI suggesting sustained bullish sentiment.

TRON (TRX) Price: Institutional Giants Pour Billions into Network As Analysts Eye Breakout

TRON's TRX token holds steady at $0.30 despite a marginal 24-hour dip, as institutional demand fuels record stablecoin activity on the network. The blockchain has cemented its position as a dominant stablecoin infrastructure provider, with USDT supply surpassing $80 billion—a 38% increase over previous records.

Three separate $2 billion USDT mints in 2025 signal institutional-scale adoption, absent in prior years. Technical indicators remain bullish: TRX maintains its position above key moving averages after breaking through the $0.30 resistance level in early July, while the MACD holds positive at 0.0071.

The network has seen over $22 billion in USDT minted in the first half of 2025 alone—already exceeding full-year totals for both 2023 and 2024. This explosive growth in stablecoin activity suggests major infrastructure deployments or institutional capital movements are underway on the TRON blockchain.

Tron Holders Pivot to Ruvi AI as Analysts Foresee $1 Valuation Post-Listing

Cryptocurrency investors are shifting focus from TRON (TRX) to Ruvi AI (RUVI), a presale-stage token gaining traction for its transparency and growth potential. Analysts project Ruvi AI could reach $1 per token after listing, drawing early interest from market participants.

The project distinguishes itself through verified smart contract security and a partnership with WEEX Exchange, ensuring liquidity upon public trading. This strategic positioning aligns with investor demand for credible, high-return opportunities in the evolving digital asset landscape.

Is TRX a good investment?

TRX presents a compelling case based on current data:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +3.58% above | Short-term bullish |

| MACD Histogram | -0.002884 | Bearish momentum fading |

| Bollinger Position | Upper band: 0.3068 | Approaching resistance |

James cautions: 'While technicals and institutional inflows are positive, investors should monitor Bitcoin's performance as a key market driver.'

Cryptocurrency investments carry high volatility risk.